Why do I keep investing in FTSE 100 stock Diageo (LSE: DGE)? Well, I like plenty of quality stocks in my Stocks and Shares ISA. But, I also like income stocks for returns through dividend reinvestment, and also growth stocks for appreciable capital gains. But, I am naturally cautious so low volatility and defensive stocks also get a look in. Diageo does a bit of everything

The Diageo dividend

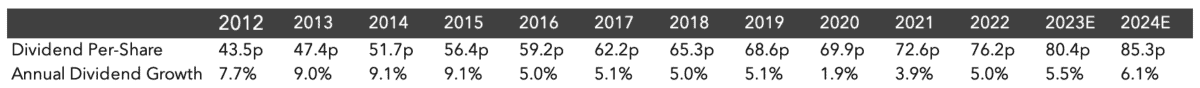

Diageo’s forward dividend yield of 2.32% is lower than the FTSE 100 average of 3.7%. But its track record is exemplary. Diageo has paid an increasing dividend for the last 10 years. Analysts have pencilled in further dividend increases for 2023 and 2024. Diageo is a Dividend Aristocrat stock.

Dividend growth has consistently been in the mid-single digits or higher, except for the pandemic years. And future shareholder payouts look safe as well, as coverage based on analyst consensus estimates is over two for 2023 and 2024.

Focus on quality growth

The Diageo share price has risen 447% over 20 years from 650p to 3,557p today. That is around 9% in capital gains every year on average before the return from dividends is added. The company’s financials have also followed a similar trend, which tells me the share price growth was justified.

In 2003 Diageo reported revenues of £8.21bn. A decade later they were £11.3bn. Analysts expect revenues of £17.3bn for 2023. Yes, there have been blips, and periods of sluggish growth along the way, most notably in 2020 and 2021, but the broad trend is decisively up. And this is a quality business: its operating margins have been consistent at around 28% over the last half-decade, and its return on equity has increased from 26% in 2018 to 44% in 2022.

A defensive FTSE 100 stock

The FTSE 100 stock with the lowest daily volatility is Reckitt on 1.55% (which I own). Diageo is in ninth place at 1.87%. All the companies in the top 10 are either consumer defensive or utilities, save one oddity in the form of Relx—a consumer cyclical, which I also own. These types of companies all share the feature of selling stuff that consumers either need or are loathe to cut back on whether times are good or tough. Hence, their revenues, and usually earnings tend to be relatively stable throughout the economic cycle and that usually helps dampen the volatility of their stock prices.

But Diageo is not a flawless stock. It is pricey at the moment with its forward P/E ratio of 20.5, which is high for its industry and when compared to the wider market. Taking into account next year’s forecasted EPS growth of 6.7%, it does not look like a growth at a reasonable price stock either, based on its PEG ratio of almost three. Nevertheless, this is something I will continue to invest in. If I was just interested in growth, maybe I would avoid it. But as I have said, Diageo also offers income and other qualities that continue to justify its inclusion in my portfolio.